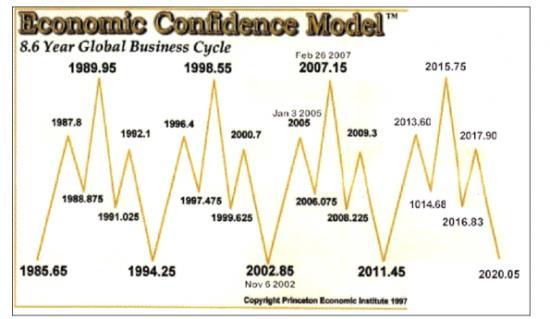

On Monday, June 13, 2011 (2011.45), one year from tomorrow, Martin Armstrong's economic confidence model predicts an 8.6 year cycle low in economic confidence:

If Armstrong is right, in all likelihood risk appetite will be very low a year from now, and safe haven assets will experience a peak.

Note that Terry Laundry's Confidence Index experienced an important low in 2002, and an important high in 2007. Not exactly the same dates that Martin Armstrong projected in 2002 and 2007, but close.

Note also that the Aden Sisters 8 & 11 year gold cycle chart projects an 11 year cycle high in gold in ~2011-12, an 8 year cycle low in ~2015-16, and another 11 year cycle high in ~2019-2020. These dates generally line up with Armstrong's calls for tops and bottoms in economic confidence over the next decade.

Friday, June 11, 2010

Friday, June 4, 2010

$GLD - Potential Cup and Handle Formation

There is a potential cup & handle pattern forming in gold. William O'Neil discovered the pattern. Some of the things he looks for in cup & handle patterns are:

1. Share price rise leading into left lip at least 30%. Here the rise was 34% from July 2009 to December 2009.

2. Cup duration usually between 13 and 26 weeks. This cup formed over 22 weeks.

3. Cup depth between 12-33%. The depth here is 18%.

4. Declining volume in the handle. Check.

5. The handle forms in the upper half of the cup above the 200-day moving average. Check.

6. Handle duration best if completes within 4-5 weeks. So far so good.

In addition, I like to see U-shaped volume in the cup formation, which we have here.

The pattern is confirmed when price closes above the right lip of the cup on a significant volume breakout. If the pattern completes, the conservative target is half the depth of the cup above the right lip, or $1345. Many times, price will exceed full cup depth added to the right lip, or $1445 in this case.

The pattern is confirmed when price closes above the right lip of the cup on a significant volume breakout. If the pattern completes, the conservative target is half the depth of the cup above the right lip, or $1345. Many times, price will exceed full cup depth added to the right lip, or $1445 in this case.

We are nearing a low risk entry point for gold. Gold closed down today at $1206.80. Should it fall back into the $1185 region over the next week or so, you could enter long with a stop at $1130 (50% of the cup depth). You'd be risking $55 for a potential gain of $160 to $260.

Subscribe to:

Posts (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)