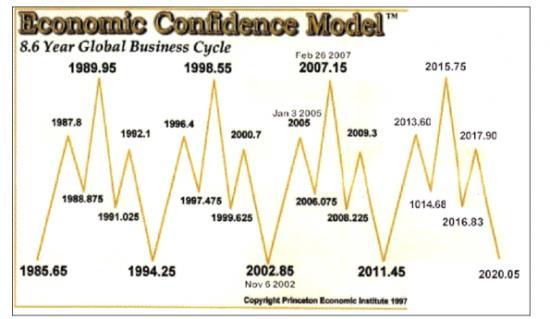

On Monday, June 13, 2011 (2011.45), one year from tomorrow, Martin Armstrong's economic confidence model predicts an 8.6 year cycle low in economic confidence:

If Armstrong is right, in all likelihood risk appetite will be very low a year from now, and safe haven assets will experience a peak.

Note that Terry Laundry's Confidence Index experienced an important low in 2002, and an important high in 2007. Not exactly the same dates that Martin Armstrong projected in 2002 and 2007, but close.

Note also that the Aden Sisters 8 & 11 year gold cycle chart projects an 11 year cycle high in gold in ~2011-12, an 8 year cycle low in ~2015-16, and another 11 year cycle high in ~2019-2020. These dates generally line up with Armstrong's calls for tops and bottoms in economic confidence over the next decade.

Brett Ratner - Wikipedia

1 day ago

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)